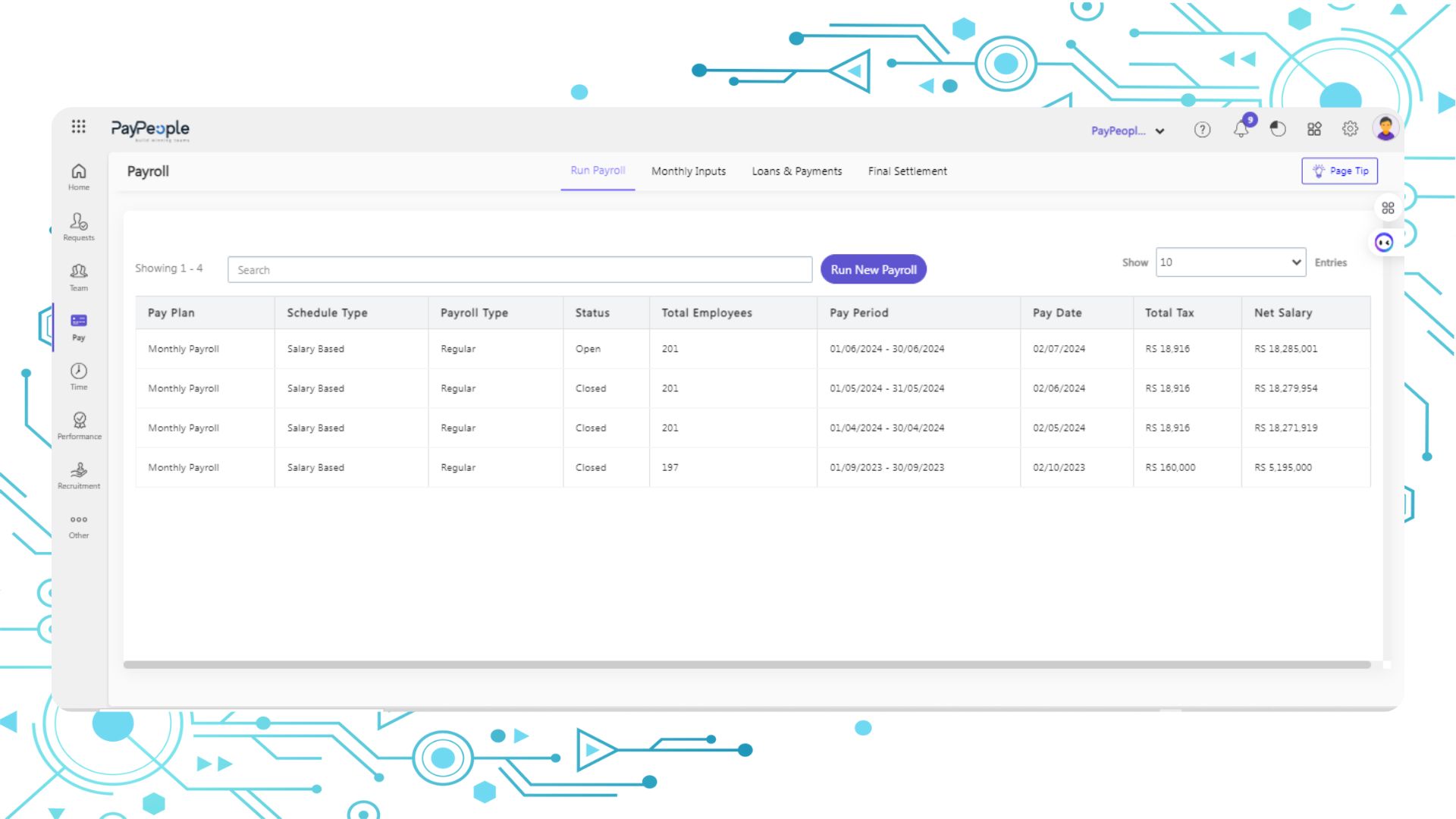

Payroll Management

Payroll processing can be handled easily and accurately with the help of PayPeople’s Payroll Management Module. It offers an easy-to-use interface for handling personnel numbers, tax computations, payroll schedules, and net salary breakdowns. Users of the system can easily execute payrolls for both closed and open pay periods.

Key Features

Essential Features to Simplify and Optimize Payroll Processes

- A complete system for monitoring pay periods, employee counts, taxes, net salaries, and salary-based payroll management.

- Create new payrolls and effectively handle the open/closed status of payroll periods.

- View, search, and filter payroll records according to the number of employees, status, and period.

- The “Run New Payroll” option is available for future pay periods.

- Monthly payroll inputs for employees should be created, managed, and tracked.

- Add new entries, import data, and keep an eye on the payroll input progress (Draft, Pending, Approved, Finalized).

- To ensure appropriate tax administration, view, search, and filter tax adjustments.

- Utilize an organized view of loans by kind, department, and location to manage employee loans and payments.

- Keep track of the loan’s due dates, installment amounts, repayment history, and recovery status.

- Fields for total payable amounts and final settlement dates are included in a special section for managing employee final settlements.

- Calculate taxes and net salary automatically for every pay period.

- Get access to comprehensive records of pay periods, tax rates, and pay amounts.