Introduction

Managing payroll efficiently is a critical task for any organization, yet it often presents significant challenges. From ensuring regulatory compliance to accurately processing employee compensation, businesses must navigate various complexities. Selecting the right payroll software can simplify these processes, improve accuracy, and enhance overall operational efficiency. This guide provides a structured approach to help companies choose the best payroll software tailored to their specific needs.

Understand Your Company’s Payroll Needs

Size and Structure of Your Business

Before selecting a payroll solution, it is essential to evaluate the size and structure of your organization. Small businesses might require simple, straightforward systems, whereas larger enterprises often need more comprehensive solutions with capabilities for handling multiple pay groups, locations, and complex workflows.

Complexity of Payroll Operations

The complexity of payroll operations varies significantly between businesses. Factors such as employee classification (full-time, part-time, contractors), varying pay scales, bonuses, overtime, and deductions must be considered when choosing software that can accommodate diverse payroll scenarios.

Integration Requirements with Existing Systems

Organizations must assess how the payroll system will integrate with their existing platforms, such as HR management systems, accounting software, and time-tracking tools. Seamless integration ensures a smoother flow of data, reducing manual work and the potential for errors.

Key Features to Look for in Payroll Software

Automated Salary Calculations and Payments

Automation is a cornerstone feature that reduces human errors and saves time. Payroll software should offer automatic salary computations, direct deposit capabilities, and the generation of pay slips.

Tax Compliance and Reporting Capabilities

Staying compliant with tax regulations is non-negotiable. A reliable payroll solution should automatically calculate taxes, generate reports, and file returns as needed, helping businesses avoid penalties and ensuring adherence to the latest legal requirements.

Employee Self-Service Portals

Modern payroll systems offer employee self-service portals, enabling staff to view payslips, download tax documents, and update personal information independently. This feature reduces the administrative burden on HR departments.

Time and Attendance Tracking Integration

An integrated time and attendance feature ensures accurate calculation of working hours, overtime, and leave balances, directly impacting payroll accuracy and employee satisfaction.

Customizable Reporting and Analytics

Customizable reporting and analytics allow organizations to generate specific insights related to labor costs, budget forecasts, and compliance audits. These reports are invaluable for strategic decision-making.

Consider User-Friendliness and Accessibility

Easy-to-Use Interface

A payroll system must have an intuitive interface that enables HR professionals and business owners to navigate features effortlessly without the need for extensive training.

Cloud-Based Access and Mobile Compatibility

Cloud-based payroll solutions offer enhanced accessibility, allowing users to manage payroll anytime and anywhere. Mobile-compatible systems further enhance convenience, especially for remote or hybrid working environments.

Evaluate Security and Data Protection

Encryption and Secure Data Storage

Payroll information is highly sensitive. Therefore, the software must utilize robust encryption protocols and secure data storage practices to protect employee and organizational data from breaches.

User Access Controls and Permissions

Role-based access controls are necessary to ensure that only authorized individuals can access specific payroll data. This layered security approach minimizes the risk of data leaks and internal breaches.

Check Customer Support and Service Quality

Availability of Support Channels

Reliable customer support is crucial. Businesses should choose a provider offering multiple support channels, including phone, email, and live chat, ensuring assistance is readily available when needed.

Onboarding Assistance and Training

Onboarding and training services help organizations transition smoothly to a new payroll system. Providers that offer detailed tutorials, demos, and personalized support facilitate a faster and more effective implementation.

Regular Software Updates and Maintenance

Payroll laws and regulations frequently change. It is vital to select a vendor that offers regular software updates, ensuring the system remains compliant and continues to meet operational needs without disruption.

Analyze Costs and Pricing Models

Subscription vs. One-Time Payment

Understanding the pricing model is essential. Subscription-based services may offer flexibility and ongoing support, while a one-time payment may be more cost-effective in the long term for some businesses.

Hidden Charges and Scalability Costs

Potential users must inquire about hidden costs such as charges for additional users, setup fees, integration costs, and future scalability requirements. Full transparency on pricing prevents budget overruns.

ROI Considerations

While cost is a significant factor, the value provided by the software in terms of time savings, reduced errors, and improved compliance should be weighed carefully to determine the true return on investment.

Read Reviews and Compare Providers

User Testimonials and Case Studies

Real-world testimonials and case studies provide insights into how the software performs across different industries and business sizes. They highlight strengths, reveal limitations, and offer practical perspectives.

Independent Review Platforms

Platforms such as G2, Capterra, and Trustpilot host unbiased reviews that help potential buyers make informed comparisons between different payroll software solutions based on actual user experiences.

Request Demos and Free Trials

Importance of Hands-On Testing

A demo or trial period allows businesses to test the software in a real-world environment, ensuring it meets operational needs before making a financial commitment.

Key Things to Observe During a Trial

During the trial period, attention should be paid to system speed, accuracy of calculations, ease of use, customer support responsiveness, and how well the software integrates with existing systems.

Make an Informed Decision

Shortlisting Final Options

After thorough research and trials, companies should shortlist two or three final contenders that best align with their requirements, budgets, and preferences.

Involving Key Stakeholders in Decision-Making

It is beneficial to involve HR professionals, finance teams, and even IT departments in the decision-making process. Their collective feedback ensures the chosen software meets technical and functional expectations.

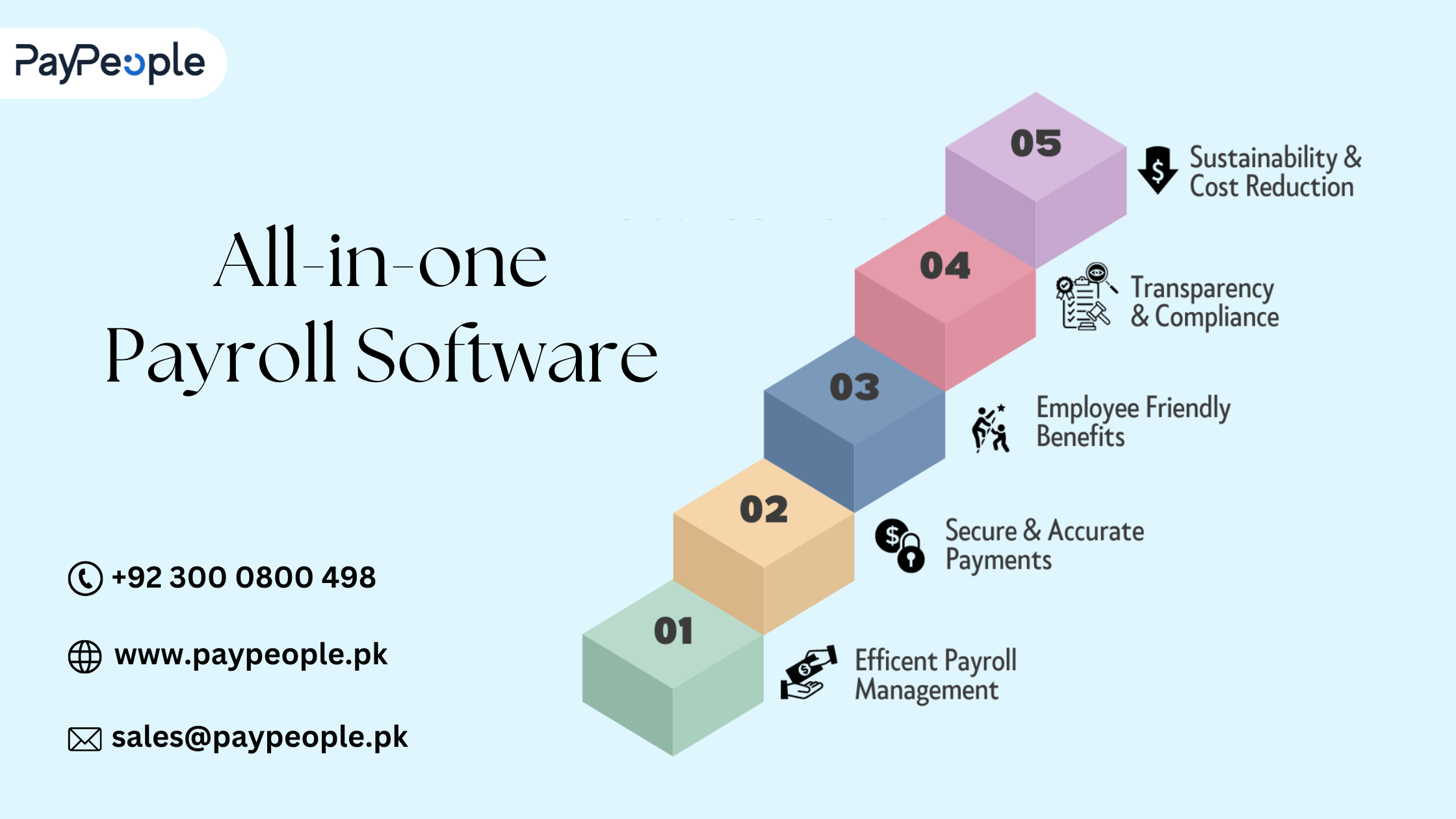

Why PayPeople Is the Right Payroll Software for Your Business

Overview of PayPeople’s Key Features

PayPeople offers a comprehensive payroll solution tailored to meet businesses’ dynamic needs. It provides automated salary calculations, tax compliance assistance, customizable reports, and employee self-service portals, all in one integrated platform.

How PayPeople Ensures Compliance and Security

With PayPeople, organizations benefit from built-in compliance updates that align with local tax laws and labor regulations. Advanced security features such as encrypted databases, role-based access controls, and secure backups ensure that sensitive payroll data remains protected.

Customer Success Stories with PayPeople

Numerous businesses across different industries have successfully streamlined their payroll operations with PayPeople. Clients frequently cite improvements in accuracy, efficiency, and employee satisfaction following the implementation of the system.

How to Get Started with PayPeople Today

Starting with PayPeople is straightforward. Interested businesses can request a personalized demo, explore various pricing plans suited to their organizational scale, and receive onboarding support to ensure a seamless transition.

Conclusion

Choosing the best payroll software requires a careful and strategic approach. By thoroughly understanding your company’s unique needs, prioritizing essential features, ensuring user-friendliness, validating security measures, assessing customer support, and analyzing costs, you can make an informed decision that aligns with your organizational goals. Moreover, considering trusted solutions like PayPeople can offer an added layer of assurance, combining innovation with reliability. Investing in the right payroll software not only enhances operational efficiency but also contributes significantly to long-term business success.